Teva Pharmaceutical Industries Limited (NYSE:TEVA) Expected to Announce Quarterly Sales of $4.29 Billion | MarketBeat

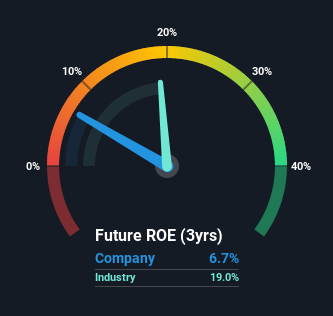

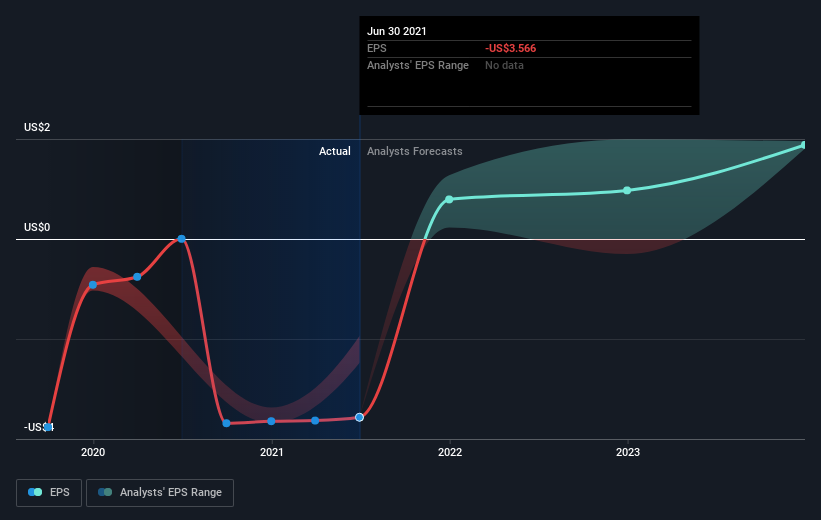

Loss-Making Teva Pharmaceutical Industries Limited (NYSE:TEVA) Set To Breakeven - Simply Wall St News

Institutions Have Been Holding Back, but Teva Pharmaceutical Industries Limited (NYSE:TEVA) is Beginning to Stabilize

Teva Pharmaceutical Industries Limited (NYSE:TEVA) Expected to Announce Quarterly Sales of $3.75 Billion | MarketBeat

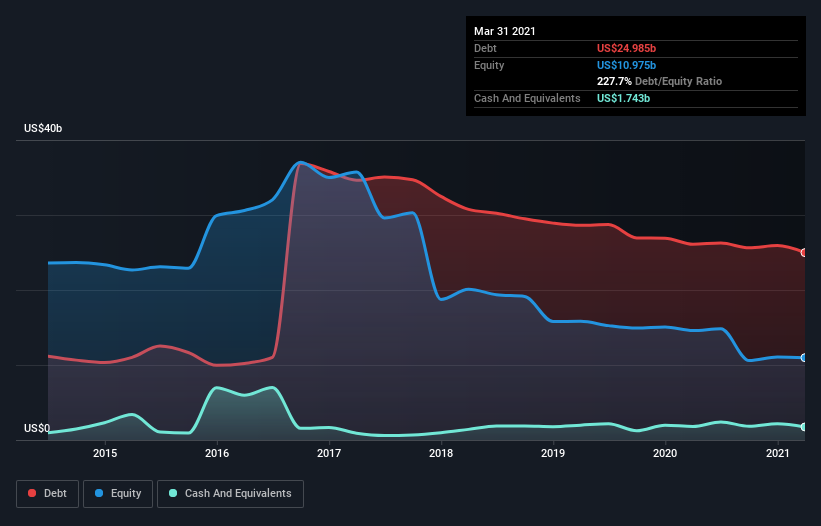

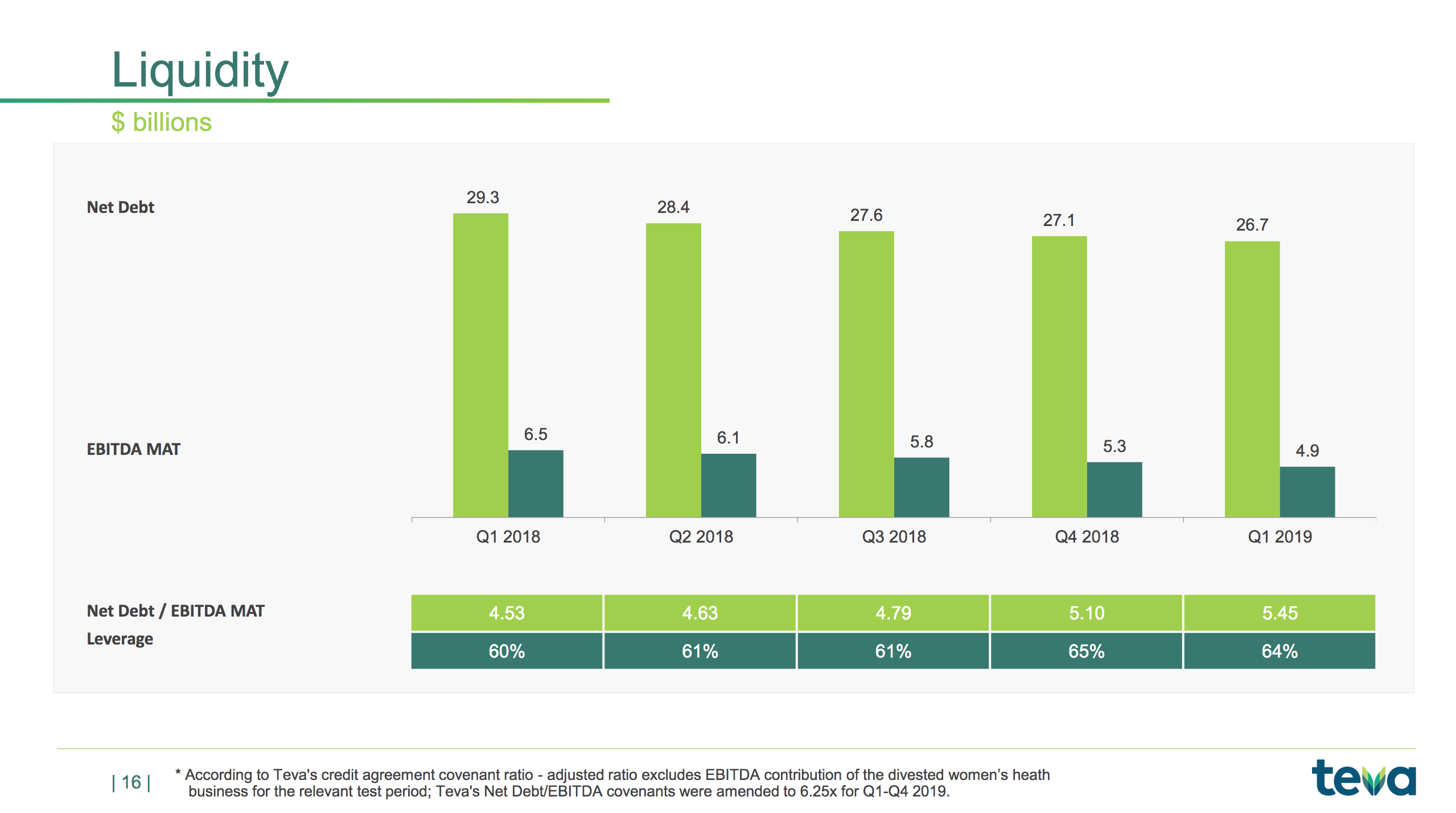

Teva May Have to Make Difficult Capital Allocation Decisions Under Pressure From Potential Generic Competition, Deleveraging Goals - Reorg

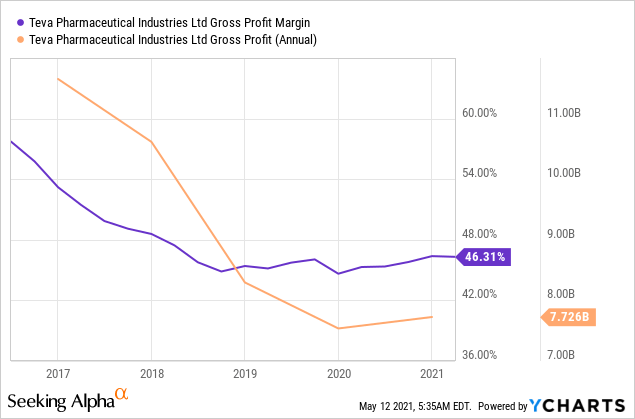

Teva still suffers from negative revenue growth and return to growth is still distant - MidgardFinance.com

The Possible Reason why Teva (NYSE:TEVA) is Still Trading Below Intrinsic Value - Simply Wall St News